Jan 29, 2024 | 7 minutes

The Best Free Invoicing Software in 2024

Let’s look at what these free invoicing tools are and the top features that any good free invoicing software will have. Visit our Make blog.

Running your finances tightly no longer means you need expensive invoicing software. So whether you’re a solopreneur, a small business, or just keeping an eye on your outgoings, free invoicing software might be the right fit for you.

Some of the best free invoicing software options in the market are so full-featured that you can send customers highly polished invoices - and they’d be none the wiser that these invoices cost you nothing to create.

Let’s look at what these free invoicing tools are and the top features that any good free invoicing software will have. We’ll also advise on how to shortlist the best options for your business.

What is invoicing software?

Invoicing software is tooling designed to help people create and send invoices - in other words, bills that others need to pay in return for products or services. Invoicing software typically also includes features for taking online payments and tracking outstanding invoices.

Why use invoicing software?

While creating invoices in word processing software like Microsoft Word is possible, using invoicing software can help:

Speed up the invoice creation process: Invoicing tools provide invoice templates, which users can use as the base of their invoices. They won’t have to manually design their invoices first, instead proceeding to add each invoice’s details right away.

Reduce invoicing errors: Once users have saved their customers’ names, addresses, and other information to their invoicing software, they can automatically insert this data into future invoices. Not having to key in this information all over again saves time and reduces the risk of making typos along the way.

Take online payments: Invoicing software typically offers payment integrations for helping users take payments via credit card and e-wallets like Google Pay. As a result, their customers have more payment options and can pay invoices quickly and more easily. For example, according to Square, over 75% of invoices created using their tool are paid within one day!) Users need only pay fees for every payment transaction made.

Top invoicing software features to look out for

As you explore free invoicing software, check if the tool has these essential features:

Customizable invoice design: To increase the professionalism of your invoices, your invoicing software should let you update your invoices’ colors and logo to match your business’. The software should ideally also let you remove its branding from your invoices.

Online payments: This is so that customers can conveniently pay your invoices using credit card, Google Pay, or other options. As a result, you get paid quicker!

Automatic payment reminders: If your invoicing software can automatically send email reminders to customers whose invoices are due soon or overdue, you’ll have one fewer task on your plate - while still ensuring that you collect payments you’re owed.

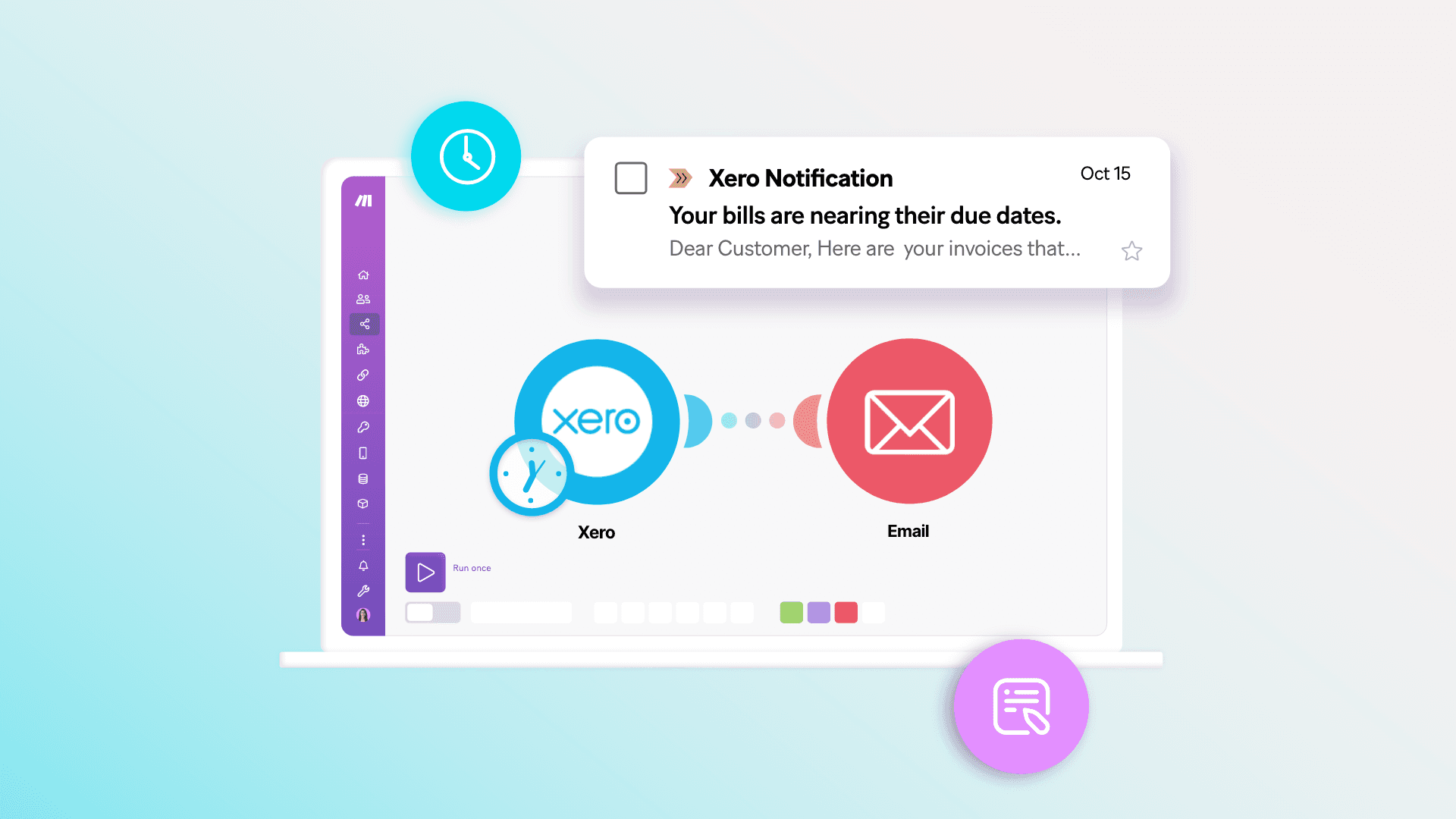

App integrations: By connecting your invoicing software with the apps you use in your business, you’ll be able to automatically send data from your invoicing software to these apps (and vice versa) for automating your workflows. The invoicing software may offer direct integration with certain apps, and may also be able to connect with others via an integration platform like Make. Bonus: the five free invoicing software we recommend below all work with Make.

The 5 best free invoicing software

1. Zoho Invoice

Zoho Invoice is part of the Zoho suite of business apps, offering a free solution for sending invoices and taking payments. It also provides a wide range of reports for tracking your sales, receivables, payments received, and other finance activity.

The platform was launched in 2008, which could be why its interface has a more classic feel. But it contains all the main invoicing features - and these work even better when you connect the platform to other Zoho apps.

By connecting Zoho Invoice to Zoho Books, for example, you can receive payments via Zoho Invoice, then reconcile them with your bank account transactions in Zoho Books.

With Zoho Invoice’s Make integration, you can automate workflows like these:

Key features of Zoho Invoice:

Create customer invoices and quotes.

Email invoices to customers immediately or schedule the emails for later.

Set up dedicated customer portals for customers to view their quotes and invoices.

Pros of Zoho Invoice:

Natively integrates with other Zoho products, including Zoho Books and Zoho CRM.

Wide range of invoice templates.

Setting up custom invoice fields is possible.

Things to be aware of with Zoho Invoice:

Your invoices will include the “Powered by Zoho Invoice” branding.

Limit of two users per organization in an account.

Zoho Invoice review by Mr. C. on G2:

“The best part about using Zoho, aside from it being free, is that it gives me exactly the features in an invoicing software that I need for my business. Client lists, easy to create and customize invoices (sic), and revenue and expense tracking are among the top highlights.”

Zoho is best for: Small businesses already using other Zoho apps (or planning to do so).

2. Wave

Wave provides beautiful, easy-to-use free invoicing software for small businesses in the United States and Canada. Creating invoices is simple, and you can set up automatic payment reminders for invoices that are coming due.

Apart from invoicing, Wave also includes accounting, payments, payroll, and mobile receipts features - making it a convenient one-stop solution for managing your business’s finances. Most of these are paid features, but you can use Wave’s accounting features for free.

Wave integrates with Make, so you can automate workflows like these:

Key features of Wave:

Create and send invoices in a simple, easy-to-use interface.

Send automatic payment reminders for invoices that are due soon.

Get a bird’s eye view of the invoice amounts coming due or overdue by a certain period.

Pros of Wave:

All of Wave’s invoicing features are completely free.

You can set up recurring invoices for customers you bill regularly.

It can help you take payments via credit card, bank payment, and Apple Pay.

Things to be aware of with Wave:

Not available to businesses outside of the United States and Canada.

Free users are generally not entitled to live and email support.

Wave review by Rebecca F. on G2:

“Very easy and practical to use, you don’t have to have an accounting background to be able to use Wave. I found it really useful using it to invoice my clients and track payments, etc.”

Wave is best for: United States and Canada-based small business owners who are new to managing a business’s finances.

3. Invoice Ninja

Invoice Ninja packs one of the most extensive feature sets we’ve seen in free invoicing platforms. The standard invoicing features are there, of course, but you can also create purchase orders and projects. You can even manage your expenses (both one-time and recurring ones).

The platform’s free plan lets you send unlimited invoices to up to 20 clients, and set up payment gateways for taking online payments. But you’ll need to upgrade to a paid plan if you want to remove the “Created by Invoice Ninja” branding from your invoices or set up automatic email reminders.

In comparison, some other platforms offer these features for free.

Make’s integration with Invoice Ninja lets you automate workflows like these:

However, you’ll need a paid Invoice Ninja plan to integrate the platform with Make.

Key features of Invoice Ninja:

Create one-off and recurring invoices.

Send invoices immediately or schedule them for later.

Track recent invoices, upcoming invoices, past-due invoices, and more from the dashboard.

Pros of Invoice Ninja:

Get a PDF preview of your invoice that updates in real time as you edit it.

The platform can notify you when a client has paid your invoice online.

You can clone one-off invoices to recurring ones to avoid the hassle of creating recurring invoices from scratch.

Things to be aware of with Invoice Ninja:

You can’t remove Invoice Ninja branding on invoices, or send automatic email reminders, on the free plan.

The platform’s interface can be overwhelming.

Invoice Ninja review by a verified G2 user:

“The layout of Invoice Ninja is basic, in a good way. It looks like a well-oiled machine that has been around for a while, so it knows what to do and what not.

[...] Things are easy to find, and the amount of features is plenty, even in the free version.

It also includes a lot of features in the free version that get you up and running your own small business in no time. Invoicing, sending quotes, and direct email to clients are all included and much needed for every business.”

Invoice Ninja is best for: Small business owners who regularly send purchase orders and quotes for projects, and who need to invoice only a handful of clients (fewer than 20 to be exact!).

4. Square Invoices

Apart from offering a popular point-of-sale solution, Square also develops invoicing tools under the Square Invoices brand for United States and Canada-based businesses.

There’s no limit on the number of invoices you can send under Square Invoices’ free plan. You can also integrate a wide range of payment methods to facilitate payment, and send customers automatic payment reminders as their invoice’s due date approaches.

But if you want to customize your invoice’s template or fields, you’ll need to upgrade to a paid plan.

If you integrate Square Invoices with Make, you can automate workflows like these:

Key features of Square Invoices:

Create flexible invoices that can accommodate discounts and service charges.

Enable online payment methods like credit card, Apple Pay, ACH bank transfer, and Afterpay.

Send invoices via email, text message, or a manual link.

Pros of Square Invoices:

Send unlimited invoices to unlimited customers for free.

You can add invoice line items by scanning a product barcode.

Conveniently send your invoices from the online dashboard, Square Invoices app, or Square Point of Sale app.

Things to be aware of with Square Invoices:

Not available to businesses outside of the United States and Canada.

No multicurrency support for invoices.

Square Invoices review by Lucas V. on G2:

“I have been using Square Invoices for about 3 months now and I absolutely recommend it. My customers receive invoices online and can pay them with a credit card; I’m able to add my products on (sic) it and also keep track of inventory. It has been a great experience so far.”

Square Invoices is best for: Small brick-and-mortar businesses in the United States and Canada - especially those that already use Square’s POS solution.

5. PayPal

PayPal is a well-known payment system that helps individuals and businesses send and receive payments. You may even have a PayPal account yourself.

The platform has a simple, free feature for creating and sending invoices, then sending automatic reminders for these. Conveniently, you can set up recurring invoices or send invoices to multiple customers at once.

But since PayPal isn’t a specialized invoicing app, it doesn’t include useful features like customizable template designs, which some competing solutions offer.

By integrating PayPal with Make, you can automate workflows like these:

Key features of PayPal:

Create individual and batch invoices.

Send invoices via methods like email and share link.

Set up recurring invoices and automatic payment reminders.

Pros of PayPal:

A native PayPal integration makes it convenient to get paid from PayPal users all over the world.

Creating invoices is straightforward.

The platform can notify you if a customer hasn’t opened your invoice by a certain time.

Things to be aware of with PayPal:

Limited reports.

PayPal’s email deliverability for invoices might not be reliable - the test PayPal invoice we emailed ourselves landed in our spam folder.

PayPal review by a verified G2 user:

“PayPal Invoicing is easy to use and [I] love that I can share a link with my clients via email to get paid fast.”

PayPal is best for: Regular PayPal users who occasionally need to send invoices.

How to choose invoicing software

We’ve shared five strong free invoicing software options, and you may have also discovered others from your research. With all these choices, how do you choose the best one for your needs?

For one, check that the invoicing software contains the top features we mentioned earlier. (These include customizable invoice design, online payments, and app integrations.)

All five free invoicing software on our list generally check off all these boxes, with some exceptions. In particular, invoices created with Invoice Ninja’s free plan or Zoho Invoice will include the platform’s branding - removing it isn’t possible.

Apart from that, your invoicing software should be user-friendly so that you won’t have trouble creating and managing your invoices. We find Wave highly easy to use, but try each platform for yourself before deciding. Especially since they can all be used for free!

Finally, the invoicing software should accommodate your business’s needs as it grows. For example, you may just need a simple tool for sending invoices for now. Next time, though, you may also need the software to help you manage your business’s books.

The invoicing software may offer these advanced features under a paid plan, so it doesn’t hurt to explore the tool’s prices and make a mental note of them for the future.

Billing software for various industries

If you’re operating in a particular field, you may need billing software that accommodates your industry’s unique invoicing needs.

Here are some options to point you in the right direction. Just be aware they may not have free plans:

Medical billing software: DrChrono, Kareo, AdvancedMD

Invoicing software for SaaS companies: Chargebee, Recurly, Stax Bill

Billing software for self-employed people: Xero, QuickBooks, FreshBooks

Should I use an invoice generator?

An invoice generator is a tool that creates an invoice based on the information you provide to it. You can find one such tool at Invoice-Generator.com:

The tool provides you with an invoice template. Fill out the template with your invoice’s details, and you can then download the completed invoice.

Other platforms that offer free invoice generators are Zoho and Invoice Simple.

We generally don’t recommend using invoice generators. Technically, all invoicing software platforms are invoice generators as they help you generate invoices. But the difference is that standalone invoice generator tools typically just generate invoices on demand and nothing more.

They don’t offer features like:

Storing your invoices (much less your customers’ information) in an account for easy access and reference.

Saving your invoice customization preferences so you don’t have to redesign your invoice each time.

Tracking invoice due dates - much less sending payment reminders for overdue invoices.

If you truly need to send an invoice just once, you may be able to get away with using an invoice generator. Otherwise, we’d recommend using invoicing software instead.

Automate your invoicing for free

Invoicing software helps you prepare invoices much quicker than manually doing them up in word processing software. But why not take things one step further, and have your invoices automatically created for you?

That’s what integrating your invoicing software with Make can do.

Our Make platform acts as a middle-man platform to connect your invoicing software with over 1,600 apps. By building automations known as Make “scenarios,” you can have your invoicing software automatically create an invoice for you when an event happens in another app. After that, you just need to review the invoice and send it if everything looks good.

Learn more about Make’s invoice automation capabilities here. And once you’ve set up your chosen free invoicing software, sign up for a free Make account to streamline your business’s invoice preparation processes even further.

FAQs

How much faster can you get paid after implementing invoicing software and automation?

Square estimates that over 75% of invoices created using its invoicing tool are paid within a day. Similarly, PayPal shares that 79% of PayPal invoices are paid within one day of being sent.

Is it worth paying for an invoice software plan?

Yes, if you regularly send invoices and need access to the tool’s paid features. These could include the removal of the invoicing software’s branding from your invoices or the setting up of automatic payment reminders. Check the tool you’re interested in to see which of its features are free to use and which require a paid plan.

What is the best invoicing software for online business management?

The best invoicing software for online business management is the one that has the features you need for creating and managing invoices easily. It should also integrate with your work apps. Some platforms have paid plans, but you may find a free option that meets your needs perfectly!

Do I need to enter a credit card to sign up for free invoice software?

There’s generally no need to enter your credit card details when signing up for free invoice software. But some may require you to, so check for this as you complete the registration process.