Automate finances and free up time for what matters

When every line item requires manual audits, you’re wasting time and money. Add Make to your toolset to connect your existing systems, and focus on what really matters by automating finance workflows like payroll, invoicing, expenses, and billing.

How does financial automation work?

With financial automation, businesses can focus on strategic financial planning while automating common tasks. Financial automation uses predefined rules and workflows to process transactions, ensure compliance, and maintain accurate financial records. Not only does this improve accuracy and reduce human error but also saves time, increases efficiency, and provides businesses with better visibility into their financial performance.

Our financial apps offer a suite of tools to manage transactions, generate financial statements, and reconcile accounts in real time, thus minimizing the need for manual data entry.

Use Cases

Explore finance workflow automation ideas

Expense Management

Manual expense management can be a drawn out process of approval workflows, receipt collection, reconciliation, and reporting. Ultimately, either too much of the team’s time is spent or too many resources are devoted to what’s just one of many accounting responsibilities. Automating expense management tasks by connecting your existing software in Make scenarios grants you better control over your finances.

Payroll Processing

Payroll processing delays are some of the biggest problems an employee can experience in their tenure with a company. But growing companies experience more complexity, which increases the risk of issues. Automated payroll solutions are one comprehensive option for managing employee salaries, taxes, benefits, and local labor laws. Find out how Make can help.

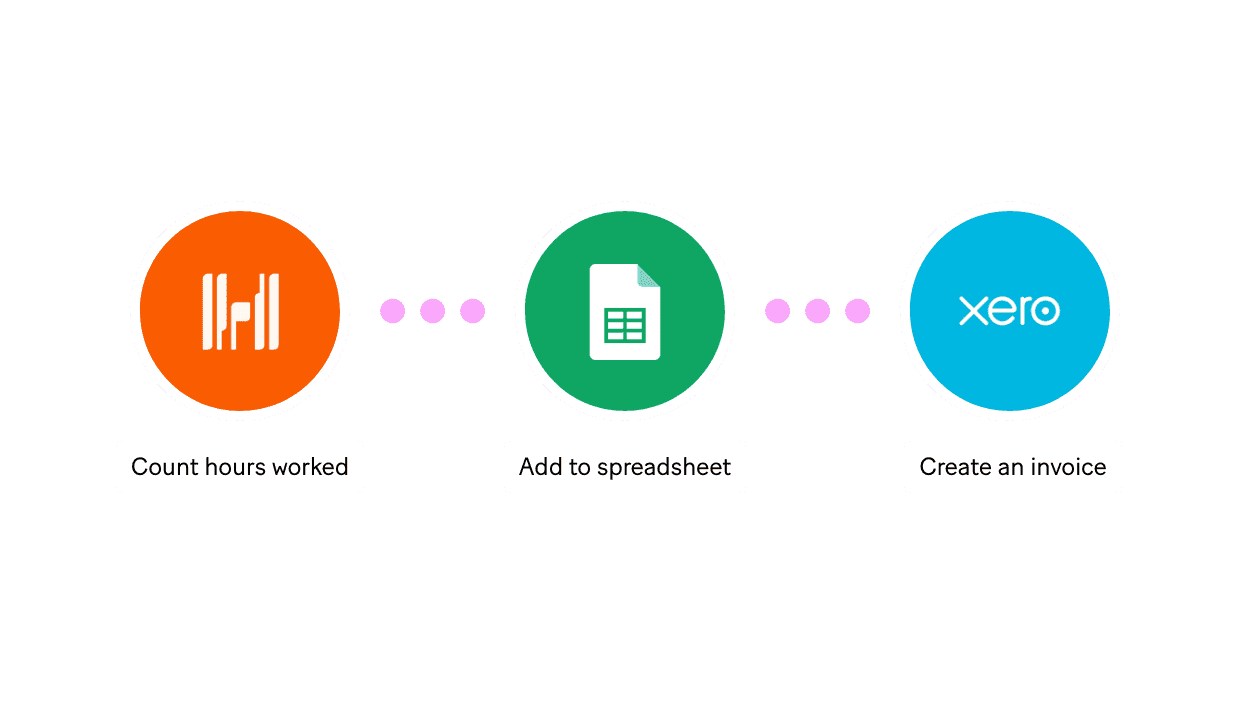

Invoicing and Billing

Keep control of cashflow and avoid situations where payments are delayed, amounts are inaccurate, and financial data is outdated. Invoicing and billing issues can add weeks of disruption to your business, all because of one manual mistake. Make's platform can connect your tools to automate your workflows, avoiding these mistakes through automated invoicing and billing management.

Inventory and Supply Chain Management

The one thing you don't need in your supply chain is hassle. By fusing together your existing supply chain management tools with Make’s straightforward visual platform, you can garner real-time insights into your operations while order processing and inventory accounting are streamlined.

Benefits of automation in finance

With Make's financial automation tool, you can set up workflows that automatically trigger actions when certain conditions are met. These automated workflows can be customized to handle key financial processes, such as payroll processing, expense management, budgeting, and financial reporting.

Streamline mundane financial tasks like invoicing and account reconciliation to save time and focus on strategic financial management.

From reporting to compliance tracking, financial automation reduces human errors and ensures consistent execution of financial processes

Leverage automated analytics for tailored financial planning and decision-making, enabling more precise and effective strategies.

How to automate your finance processes

Ready to start reaping the benefits of Make's finance automation? We've got what you need to get started.

Pinpoint common tasks such as invoice processing, expense tracking, or budget reconciliation that can be automated to save time and reduce manual effort.

Select a reliable platform, like Make, that integrates with your accounting software, supports your financial goals, and fits your budget and existing tech stack.

Explore Make's ready-to-use finance templates to find quick solutions for common financial automation tasks.

Create step-by-step workflows to streamline your financial operations, ensuring accurate data management and integration with tools like ERP systems or expense management platforms.

Learn from business turning automation vision into reality

FAQ

How it works

Traditional no-code iPaaS platforms are linear and non-intuitive. Make allows you to visually create, build, and automate without limits.